Explore how Trump’s tariff threats impact the stock market and discover the Nasdaq’s surprising resilience amidst economic uncertainty.

Introduction

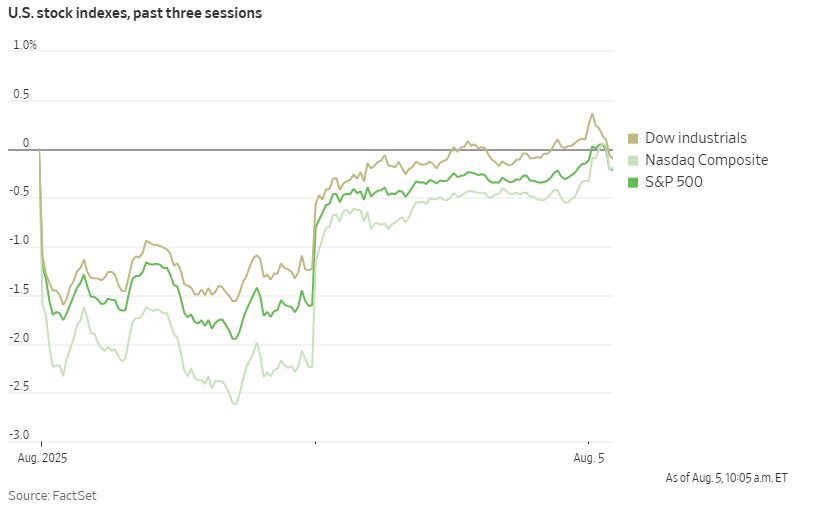

The stock market is a complex ecosystem, constantly shifting in response to a myriad of factors. Today, that volatility is on full display as investors grapple with two major headlines: President Donald Trump’s latest pronouncements on tariffs and a simultaneous rise in the tech-heavy Nasdaq Composite. On the surface, these two events seem to be at odds. New tariffs are typically seen as a headwind for the global economy, yet the Nasdaq, often a bellwether for investor confidence, is moving higher. This blog post will delve into the details of these developments, exploring why the market is behaving this way and what it means for investors.

Trump’s New Tariff Threats: A Familiar Tune with New Targets

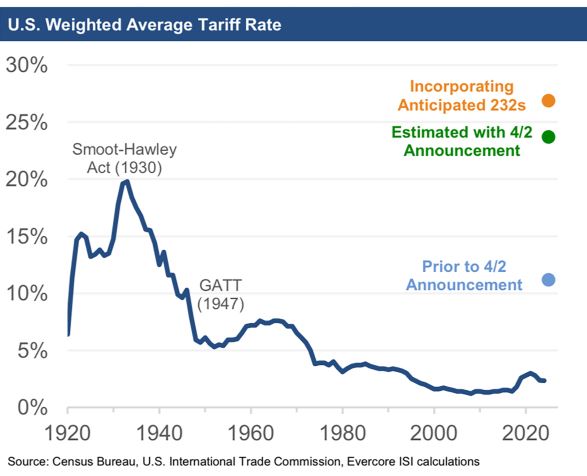

Donald Trump’s approach to trade policy has long been characterized by a willingness to use tariffs as a negotiating tool. His latest statements, however, are sending new ripples through specific sectors. He has announced his intention to impose tariffs on imports of chips and pharmaceuticals, two of the most critical and complex industries in the modern economy.

The Semiconductor and Pharmaceutical Industries in the Crosshairs

The semiconductor industry is the backbone of modern technology. From smartphones and laptops to artificial intelligence and electric vehicles, every piece of technology relies on these intricate components. The global supply chain for semiconductors is incredibly interconnected, with different stages of design, manufacturing, and assembly often taking place in different countries. A tariff on these goods, therefore, could disrupt this delicate balance, increasing costs for U.S. companies and potentially leading to higher prices for consumers.

Similarly, the pharmaceutical industry is a global behemoth. Many of the drugs Americans rely on are manufactured, at least in part, overseas. Trump’s proposed tariffs are a stated effort to bring pharmaceutical manufacturing back to the United States, but the immediate impact could be a rise in the cost of essential medicines. This is a highly sensitive topic, as it directly impacts public health and personal finances.

Why the Threats Matter Now

While Trump’s tariff rhetoric is not new, the specific targeting of these industries is significant. These are not general, across-the-board tariffs. They are aimed at sectors that are deeply integrated into the American economy and consumer’s daily lives. This precision creates a new layer of uncertainty, forcing companies and investors to reassess their strategies. It also puts pressure on foreign governments, who may be forced to respond with their own retaliatory measures, escalating trade tensions. The potential for a new “trade war” is a risk that the market cannot ignore.

The Nasdaq’s Curious Rise: A Deeper Look at Market Dynamics

Despite the looming threat of tariffs, the Nasdaq Composite is showing surprising strength. This is not a simple contradiction, but rather a reflection of the intricate forces at play in the market. Several factors are contributing to the Nasdaq’s upward momentum, and understanding them is key to making sense of the day’s trading.

The Power of Big Tech Earnings

The Nasdaq is heavily weighted toward technology stocks, and many of these companies have recently reported strong earnings. These reports have shown a resilience and growth that is largely insulated from the immediate impacts of trade policy. Giants in the tech space, particularly those focused on software, cloud computing, and artificial intelligence, are continuing to see robust demand. Investors, seeing these strong fundamentals, are buying into these companies, driving up their share prices and, by extension, the overall index.

The ‘Flight to Quality’ and Domestic Focus

Another factor at play is the “flight to quality” phenomenon. When faced with economic uncertainty, investors often seek out companies that are perceived as stable and reliable. Many of the large-cap technology companies on the Nasdaq fit this description. They have strong balance sheets, diverse revenue streams, and a dominant position in their respective markets. Investors may be seeing these companies as a safe haven, even amidst the backdrop of trade tensions.

Furthermore, many of these tech companies have a strong domestic focus. While they operate globally, their primary markets and revenue streams are often in the United States. This makes them less vulnerable to the direct impact of tariffs on imported goods. A company that sells software services, for example, is far less exposed to a tariff on imported physical components than a company that manufactures hardware. This domestic insulation provides a buffer against the trade headwinds that are impacting other sectors.

The Fed’s Potential Role

The Federal Reserve also plays a crucial role in market sentiment. The possibility of new tariffs and the potential for a slowing economy increases the likelihood that the Fed will take action to stimulate growth. This could mean interest rate cuts or other monetary policy adjustments. Anticipation of such a move can be a powerful driver for the stock market, as lower interest rates can make borrowing cheaper and boost corporate profits. Investors may be buying into the market today, betting that the Fed will step in to provide a backstop should the economic situation worsen.

The Bigger Picture: Navigating a Market of Contradictions

The seemingly contradictory movements of the day—Trump’s tariff threats and the Nasdaq’s rise—are a perfect example of a market grappling with multiple, competing narratives. On one hand, there is a clear and present risk of a trade war that could negatively impact global supply chains, corporate profits, and consumer prices. On the other hand, there are strong, fundamental drivers in the technology sector, supported by a belief that the Federal Reserve will act to prevent a significant economic downturn.

For investors, this is a time for careful consideration. The market is not a monolith, and different sectors will react to these headlines in different ways. Companies with complex global supply chains or a reliance on imported goods will likely face more pressure. Conversely, companies with strong domestic revenue streams and robust earnings may continue to perform well.

Ultimately, the market is a forward-looking mechanism. Today’s movements are not just about what is happening now, but also about what investors believe will happen in the future. The Nasdaq’s rise suggests a belief that the long-term fundamentals of the technology sector are strong enough to weather any short-term trade storm. However, the risk of escalation remains. As the situation evolves, investors will need to stay nimble and adjust their strategies accordingly.

The Long-Term View: Tariffs, Tech, and the Future of Investing

The current market environment highlights a critical truth about modern investing: it’s not just about economics, but also about politics and policy. The decisions made by leaders can have profound and immediate impacts on specific industries and the broader market. The intersection of trade policy, corporate performance, and central bank actions is a complex one, and successfully navigating it requires a deep understanding of all these factors.

The story of today’s market is a tale of two forces: the potential for a trade slowdown and the undeniable momentum of technological innovation. For now, it seems the market is betting on the latter. But as the details of the proposed tariffs become clearer and their real-world impact begins to materialize, the balance could shift. For investors, the key is to not get caught up in the daily noise, but to maintain a long-term perspective, focusing on the fundamentals of the companies they own and the resilience of the economy as a whole.