Explore the implications of Trump’s new tariffs and their projected $300B impact on the economy. Dive deep into the analysis and expert insights today.

Introduction

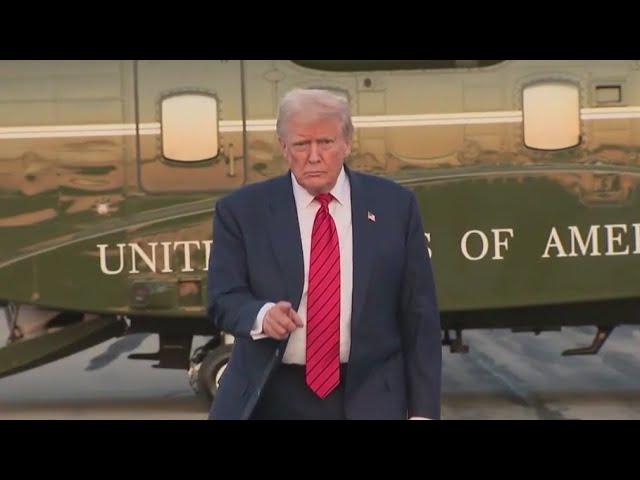

The global economy is once again at a crossroads as the United States, under the leadership of President Donald Trump, doubles down on its protectionist trade policies. The Wall Street Journal’s recent report projecting a staggering $300 billion in tariff revenue for the year has sent shockwaves through international markets and economic circles. This figure, a significant leap from previous tariff collections, is not just a number; it represents a fundamental shift in U.S. economic strategy with far-reaching consequences for businesses, consumers, and international relations.

This deep dive will unpack the complexities of these new tariffs, explore the potential economic impacts, and analyze the arguments for and against this bold new approach to global trade.

The New Tariff Landscape: A Shift in Strategy

The most recent wave of tariffs, and the one responsible for the dramatic revenue projections, is a significant departure from the more targeted levies of the past. While previous tariffs were often focused on specific countries and industries, such as steel and aluminum, the new proposals are far broader. Reports suggest a universal tariff on all imports, with higher rates for countries with which the U.S. has a significant trade deficit.

This “reciprocal tariff” approach is based on the administration’s belief that trade deficits are inherently harmful and that a blanket tariff is the most effective tool to force trading partners to the negotiating table. The strategy aims to rebalance trade by making foreign goods more expensive, thereby encouraging domestic production and reducing the trade deficit.

Who Pays the Price? The Economic Impact of Tariffs

The central question surrounding any tariff policy is: who ultimately bears the cost? While the administration often frames tariffs as a way to make foreign countries “pay,” the reality is far more complex.

Economists are in broad agreement that the cost of tariffs is primarily passed on to domestic consumers and businesses. Importers, who are the ones that actually pay the tariff at the border, will almost certainly pass those increased costs along to wholesalers, retailers, and eventually, the end consumer. This means that a tariff on imported electronics, for example, will lead to higher prices for everything from smartphones to computers in American stores.-$300B

Beyond the consumer, American businesses are also hit hard. Manufacturers that rely on imported parts and raw materials will face increased costs, which can erode profit margins and make them less competitive. This can lead to a ripple effect throughout the economy, potentially slowing down growth and investment.

A Look at the Projected $300 Billion

The $300 billion revenue figure is a powerful headline, but it’s crucial to understand its context. This is not a windfall that comes at no cost. This revenue is being generated by a tax on American consumers and businesses. While the government receives the money, the American public is the one footing the bill through higher prices on everyday goods.$300B

Furthermore, economic models from various organizations, including the Penn Wharton Budget Model and the Tax Foundation, have warned of the long-term consequences. These models project that a broad-based tariff policy could lead to a decline in GDP, lower wages, and a reduction in the capital stock. The revenue generated, while substantial, is not enough to offset the economic drag caused by the tariffs.

Retaliation and Global Trade Wars

The U.S. is not operating in a vacuum. The implementation of broad tariffs on its trading partners almost certainly invites retaliation. Other countries, in turn, may impose their own tariffs on American exports. This can lead to a trade war, where each country raises tariffs in response to the other, ultimately harming businesses and consumers on both sides.

A full-blown trade war would be a significant blow to the global economy. It would disrupt supply chains, create uncertainty for businesses, and make it more difficult for countries to trade with each other. For American exporters, particularly those in the agricultural and manufacturing sectors, retaliatory tariffs could be devastating, costing them access to key foreign markets.

The Arguments for Tariffs: A Case for Protectionism-$300B

Despite the economic warnings, proponents of the new tariff policy argue that it is a necessary measure to protect American industries and workers. They contend that decades of free-trade agreements have led to a decline in domestic manufacturing, with jobs and production being offshored to countries with lower labor costs.

The argument is that tariffs create a level playing field by making foreign goods more expensive, thus making domestically produced goods more competitive. This, in theory, would lead to a resurgence of American manufacturing and the creation of new jobs.

Additionally, the administration sees tariffs as a powerful tool to address what it views as unfair trade practices, such as intellectual property theft and currency manipulation. The threat of tariffs is intended to force countries to change their behavior and engage in fairer trade.

The Future of American Trade: Navigating a New Era-$300B

The projected $300 billion in tariff revenue is a testament to the scale of the new administration’s trade policy. Whether this bold, protectionist strategy ultimately revitalizes American industry or leads to an inflationary cycle and a global trade war remains to be seen.

One thing is clear: the era of relatively unfettered global trade is over, at least for now. Businesses and consumers alike must adapt to this new reality, which promises higher prices, disrupted supply chains, and a heightened sense of uncertainty. The outcome of this grand economic experiment will shape not just the American economy, but the entire global financial landscape for years to come.