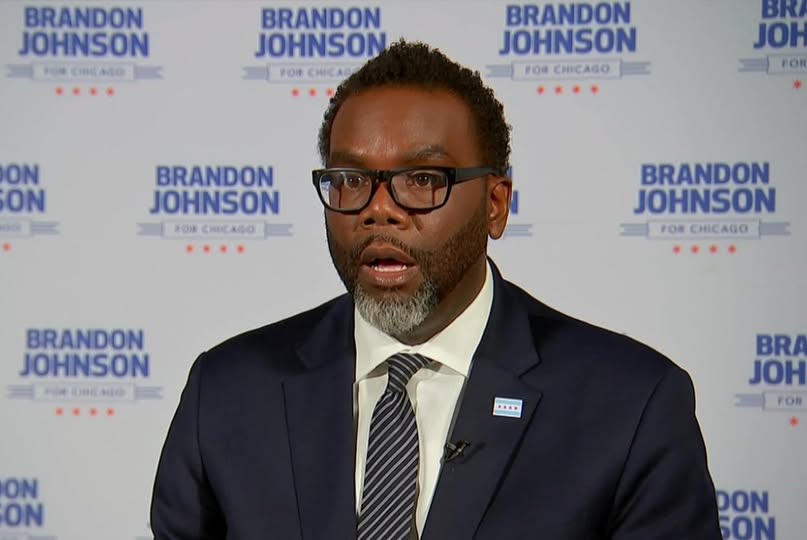

Explore Mayor Brandon Johnson’s urgent ultimatum for Chicago as the city faces a critical “Point of No Return.” Discover the implications for its future.

Chicago, a city known for its bold architecture, vibrant culture, and deep-dish pizza, now faces a financial crisis that threatens its very foundation. Mayor Brandon Johnson has issued a stark warning, declaring the city’s finances are at a “point of no return” without immediate and significant tax hikes. This dramatic statement has thrust the city’s precarious financial state into the national spotlight and ignited a fierce debate over the best path forward for the Windy City.

Licensed by Google

The Fiscal Abyss: A City’s Growing Deficit

Chicago’s financial woes are not new, but they have reached a critical tipping point. For years, the city has grappled with a structural budget deficit, a persistent problem where expenses consistently outpace revenue. The situation has been exacerbated by a massive pension debt, with the city’s four pension funds being among the worst-funded in the nation. According to recent reports, the city’s pension systems have just a fraction of the money needed to cover promised benefits, creating a mountain of debt that grows larger each year.

The current crisis has been made more acute by a number of factors. While Chicago’s budget has grown significantly since the pre-pandemic era, with billions in federal relief funds, that temporary influx of cash is now dwindling. This has left the city with a substantial budget gap, projected to be over $1 billion for the next fiscal year. This deficit is not merely a bookkeeping problem; it’s a direct threat to the city’s ability to maintain essential services, from public safety to sanitation.

The Mayor’s Proposals: A Call for “Progressive” Revenue

In response to this looming crisis, Mayor Johnson has made it clear that he believes the solution lies in “progressive revenue solutions.” This approach, which he campaigned on, aims to increase taxes on the city’s wealthiest residents and corporations rather than raising property taxes on homeowners. Johnson has publicly rejected a property tax hike, a politically fraught move that has been met with strong resistance from Chicagoans in the past.

Among the specific proposals being considered are:

- A Corporate “Head Tax”: This is a per-employee tax on businesses, a policy that Chicago had in place for decades before it was repealed. The idea is to make businesses with a significant workforce contribute more to the city’s coffers.

- A “Corporate Excise Tax” or Payroll Tax: This more ambitious proposal would tax the payroll of businesses, particularly targeting those with a high number of employees earning over a certain income threshold. Proponents argue this would be a more equitable way to raise a significant amount of revenue.

- A Tax on Social Media Advertising: This innovative tax would target the billions of dollars in revenue generated by digital advertising within the city. While it’s a new and largely untested idea, Johnson believes it’s a viable way to tap into a booming industry.

- Taxes on Services: The city is also exploring the possibility of expanding its sales tax to include services like haircuts or accounting, a move that would require state legislative approval.

Johnson and his allies argue that these taxes are necessary and fair, pointing out that Chicago is home to thousands of millionaires and dozens of billionaires who have benefited from a growing economy. He believes it is time for them to “put more skin in the game” to support the city.

The Backlash and Opposition: Concerns for the City’s Economic Health

Mayor Johnson’s proposals, while popular with some of his political base, have been met with fierce opposition from the business community and a number of city council members. The Chicagoland Chamber of Commerce and other business groups have warned that new taxes on businesses would be a “job killer,” arguing that they would discourage companies from locating in or staying in Chicago. They fear that a new head tax or payroll tax would prompt businesses to move their employees outside the city limits, ultimately hurting the city’s economy and reducing its tax base in the long run.

Opponents also point to the city’s history with the head tax, which was repealed a decade ago under a previous administration that deemed it a competitive disadvantage. There are also legal concerns about the constitutionality of some of the proposed taxes. The debate highlights a fundamental difference in philosophy: Johnson’s supporters believe the city’s financial problems can be solved by making the wealthy pay more, while his critics argue that an unfavorable business climate will ultimately harm everyone.

The Future of Chicago: A Critical Juncture

The next few months will be a critical period for Chicago. Mayor Johnson’s administration is expected to present its official budget proposal, which will outline the specific tax hikes he intends to push for. The City Council, which has already shown reluctance to approve a property tax increase, will have to decide whether to support these new, and in some cases, controversial measures.

The city’s financial health is more than just a matter of numbers. It affects the quality of life for every resident, from the funding of schools and parks to the salaries of police officers and firefighters. The outcome of this debate will not only determine how Chicago closes its budget gap, but also what kind of city it will be in the future. The choices made today will either pave a path to fiscal stability or push Chicago further toward the “point of no return” that Mayor Johnson has so urgently warned about.

Chicago Mayor Brandon Johnson, Chicago finances, budget deficit, tax hike, corporate tax, head tax, payroll tax, Chicago City Council, public policy, economic impact, progressive revenue, Chicago business community, city budget, pension debt

Here’s a video on a proposed property tax increase by Mayor Brandon Johnson. This will provide more context on the discussion on taxes.

Mayor Johnson proposes $300M property tax increase in 2025 budget proposal, but no layoffs

$300M property tax increase in Mayor Brandon Johnson’s 2025 budget proposal, but no layoffs – YouTube