Explore the bold proposal by DeSantis addressing the property tax dilemma. Discover insights on potential impacts and solutions for Florida residents.

The idea of homeownership has long been a cornerstone of the American Dream, a symbol of stability, and a means of building generational wealth. Yet, for many, that dream is increasingly burdened by rising property taxes. It’s a sentiment Florida Governor Ron DeSantis has tapped into with his provocative stance on the issue, famously questioning the fundamental nature of the tax itself. “To say you’re just enjoying property and all of a sudden the value [goes up] – you have to pony up [to the government?] We don’t really do that in anything else!” he remarked, sparking a statewide and national debate about the role and function of property taxes. This blog delves into DeSantis’s perspective, exploring the arguments for and against his proposals, and examining the potential consequences for Floridians and beyond.

The Governor’s Rationale: “Paying Rent to the Government”

At the heart of DeSantis’s argument is the belief that property taxes are a form of perpetual “rent” paid to the government for a property one already owns. He views this as an antiquated and often unjust system, where homeowners—particularly those on fixed incomes or in rapidly appreciating neighborhoods—are penalized for their property’s increased value. This can create a precarious situation where a homeowner’s financial stability is threatened, not by a lack of income or poor financial decisions, but simply by market forces beyond their control. DeSantis has consistently framed his efforts as a way to put Florida residents first, contrasting property tax relief with sales tax cuts that would also benefit tourists and non-residents.

The Appeal of Elimination

The governor has proposed a constitutional amendment to be placed on a future ballot that would, if passed, eliminate property taxes for homesteaded properties in Florida. This is a powerful, attention-grabbing proposal that resonates deeply with many voters. The prospect of no longer paying thousands of dollars each year for a home you’ve paid off is a potent political message. It speaks to a desire for greater individual liberty and a reduction of government’s financial grip on its citizens. For many, especially seniors, this would provide immense relief and security.

The Counterarguments: A House of Cards?

While the promise of no property taxes is attractive, critics and policy experts have raised serious concerns about the potential fallout. The most significant question is: how would local governments and school districts make up for the massive loss of revenue? Property taxes are the lifeblood of local funding, paying for essential services like schools, police departments, fire-rescue, and infrastructure.

The Search for a Replacement

The revenue generated by property taxes in Florida is immense, estimated to be tens of billions of dollars annually. To simply eliminate it without a viable replacement would lead to a catastrophic collapse of local services. Possible solutions, such as increasing sales taxes, have been floated, but these come with their own set of problems. A significant increase in sales tax would likely be regressive, disproportionately affecting low-income families and seniors. It would also shift the financial burden from property owners to all consumers, including renters who would not benefit from the property tax elimination. Furthermore, a sales tax is less reliable than a property tax, as it fluctuates with economic conditions.

The Impact on the Housing Market

Another concern is the potential impact on Florida’s already turbulent housing market. Experts predict that eliminating property taxes would cause a surge in home values, as buyers would be willing to pay more for a property with no annual tax liability. This could make homeownership even more unattainable for first-time buyers and exacerbate the state’s affordability crisis. It would essentially create a windfall for existing homeowners while making it harder for new generations to achieve the American Dream.

The Political and Fiscal Tightrope

The debate over property taxes highlights a fundamental tension in American governance: the balance between providing tax relief to citizens and adequately funding essential public services. DeSantis’s proposal, while popular with many, is not without its political and fiscal risks. He has faced pushback from the state legislature, and the specifics of how such a plan would work remain a major point of contention. The discussion has become a high-stakes game of political chess, with different factions of the government advocating for their preferred tax cuts and priorities. The outcome will depend on the ability of lawmakers to find a solution that provides meaningful relief to residents without jeopardizing the quality of life that makes Florida so attractive in the first place.

This entire debate forces us to reconsider what we want from our government and how we are willing to pay for it. Is the burden of property tax truly unjust, or is it a necessary and efficient way to fund the local services that everyone relies on? DeSantis has framed the question, but the answers are far from simple, and the road to a solution is filled with obstacles.

taxes, property taxes, Ron DeSantis, Florida, tax relief, homestead exemption, sales tax, government funding, local services, housing market

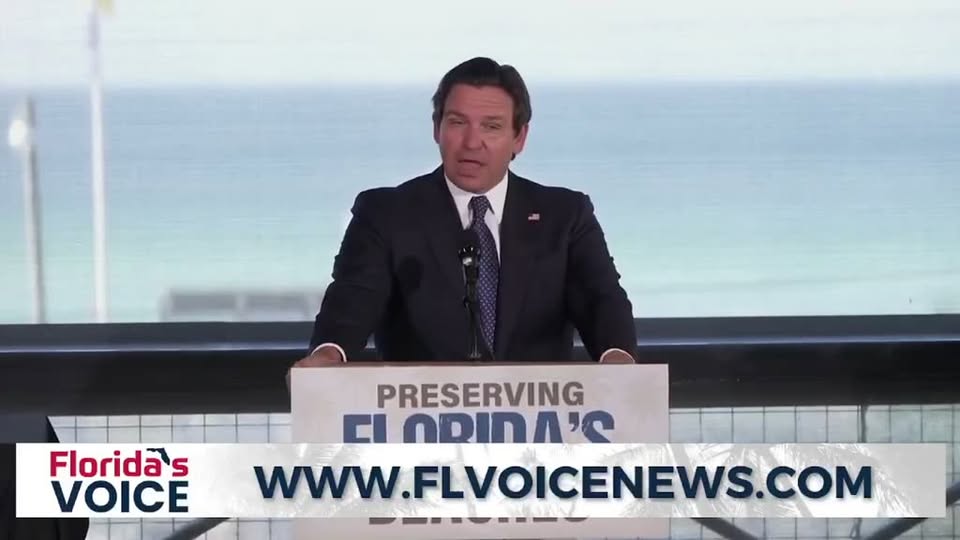

Governor Ron DeSantis discusses property tax relief This video is a relevant clip where Governor DeSantis directly discusses his views on property tax relief and the need for a constitutional amendment to address the issue.

Gov. DeSantis discusses property tax relief – YouTube